What Is Withholding Tax In Sap

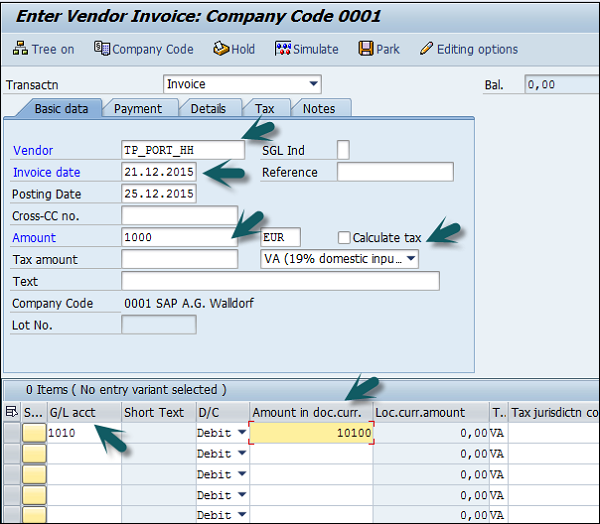

Enter the vendor id withholding tax enabled of the vendor to be invoiced.

What is withholding tax in sap. Post withholding tax during payment posting. The withholding tax the sap system provides two functions. Indirect tax and withholding tax.

Issf in portuguese imposto sobre servicos na fonte if the vendor is a natural person and is not registered in the city where he or she is providing the service then the customer withholds iss. One or more can be assigned in the vendor master record. Check document type.

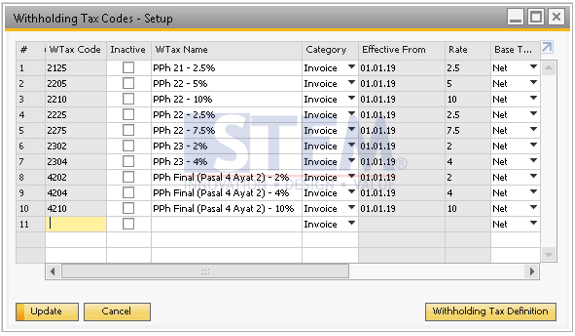

The withholding tax type governs the way in which extended withholding tax is calculated and is defined at country level. Step 2 in the next screen enter company code you want to post invoice to. Several withholding tax types can be defined in the system.

Withholding taxes are calculated in the source system and transferred to the central finance system exactly as they are posted in the source system. It also comes with a number of smart forms that you can use to print withholding tax certificates. The customer then pays the tax withheld directly to the appropriate tax authorities.

It s a kind of indirect tax. Extended withholding tax from release 4 0. In colombia the main withholding taxes include.

In one business transaction several kinds of withholding tax may have to be withheld. To calculate pay and report. The system calculates iss according to the standard iss calculation and the withheld tax itself is called issf.

Vendor subject to withholding tax the customer reduces the payment amount by the withholding tax proportion. Industry and commerce tax which is known as impuesto de industria y comercio. Sap ariba procurement solutions support two tax categories.

The extended withholding tax solution comes with sample settings for a range of withholding taxes. Its requirement of government to deduct or withhold a particular percentage from paying to the vendor and pay such amount to the government on behalf of other person. Step 3 in the next screen enter the following.

As far as the time of posting for withholding tax amounts is concerned there are two different categories of. All the configurations for the withholding tax is done in the following tab only. Withholding tax is also called as retention tax.

These taxes are added to the total invoice amount and paid to the supplier who in turn pays them to the government. The sap system uses withholding tax types to reflect this. Step 1 enter transaction fb60 in sap command field.